💎 Growth Gems #74 - Pricing, Paid UA and Ad Monetization

Hey,

This week I’m sharing gems on:

These insights come from Marvin Eschenauer, Simon LeJeune, Anton Volovyk, Giancarlo Musetti and Sree Das.

Enjoy!

🥇 TOP GEM OF THE WEEK

Ad Monetization: adding rewarded videos

The mining of MAU Vegas continues ⛏️

In the last edition, there was a gem by Jakub Chour where he shared they had added rewarded videos for some users.

The insights from the talk below are on this topic exactly.

Marvin Eschenauer (Head of Business & Growth at Bytro) walks us through how they approached the topic in Changing the Monetization Strategy on Live Products: A 2021 Case Study from Bytro.

💎 If you’re coming from in-app purchases only and want to include ads, rewarded videos will be less intrusive. Below is the ABC test that Bytro initially ran in one of their strategy games and the results.

Marvin Eschenauer (Head of Business & Growth at Bytro)

at 07:02

💎 Once you implement ad monetization, it seems that ad networks initially “jump on it,” which inflates the eCPM you see at the beginning. In the case of Bytro, eCPM ended up being about 20% lower than the first two weeks.

Marvin Eschenauer (Head of Business & Growth at Bytro)

at 13:57

💎 Getting an uplift in monetization (e.g., 17 to 30% revenue per user from adding rewarded videos for Bytro) also unlocks user acquisition opportunities because you can afford a higher cost per acquisition.

Marvin Eschenauer (Head of Business & Growth at Bytro)

at 14:45

💎 Even with relatively similar games, the rewards you offer for watching rewarded videos (low rewards vs. high rewards) might perform differently in terms of ARPU for “IAP + rewarded videos.” Test different options. Example: Bytro saw better results with high rewards in one game and better results with low rewards in the other.

Marvin Eschenauer (Head of Business & Growth at Bytro)

at 15:38

💎 Once you’ve rolled out your initial ad setup, you can still get some significant improvements by iterating on the number of rewarded videos allowed daily. Example: +10% ARPU when going from 5 to 8 ads for Supremacy on Android.

Marvin Eschenauer (Head of Business & Growth at Bytro)

at 15:51

💎 A lot of things can impact ad performance while you’re testing new things in monetization: game development, user acquisition, IAP promotions, and LiveOps. Keep an overview of everything else going on, and look at specific breakdowns (e.g., US-only impact, old vs. new users).

Marvin Eschenauer (Head of Business & Growth at Bytro)

at 16:40

Paid UA: brand marketing, UGC ads

Some growth experts’ appearances are rare.

That’s the case for Simon Lejeune (VP Growth at Wealthsimple).

I featured some gems from Simon in Growth Gems #12 and was glad to see him take the stage at MAU in To the Moon! How Wealthsimple became the #1 Fintech Super App in Canada.

💎 WealthSimple invested in brand marketing much earlier than most startups. This is particularly important in FinTech, where trust plays a huge role.

Simon Lejeune (VP Growth at Wealthsimple)

at 06:57

⛏️ Going Deeper: investing in brand marketing doesn’t mean not investing in digital ads. Adam Hadi (VP Marketing at Current) shared here that a huge out-of-home campaign won’t work if people don’t know how your product differentiates and what your brand is. This is also what Eric Seufert shared in his post The perilous mythology of Brand Marketing for digital products.

💎 ARPU can be tough to predict, especially for an investing app, because you can’t predict trading volume. Be relatively conservative and maximize customer growth at 1-year blended payback when considering your target CAC.

Simon Lejeune (VP Growth at Wealthsimple)

at 12:15

💎 Brand vs. performance is a false dichotomy. It’s all media with more or less tracking. Better questions are:

How far do you need to take performance creatives?

Can you buy brand love with incentives (instead of spending on paid acquisition channels)?

Simon Lejeune (VP Growth at Wealthsimple)

at 14:40

💎 Incentive ads always win (e.g., for WealthSimple: free stock, free dogecoin, etc.), but mix them with other formats.

Simon Lejeune (VP Growth at Wealthsimple)

at 18:31

💎 With more and more advertisers following the playbook of UGC ads, many ads look the same, and the quality is low. Instead of this being a conflict with your brand team, think about finding the creators that can create really good UGC/influencer ads.

Simon Lejeune (VP Growth at Wealthsimple)

at 19:21

💎 The best performing ad of WealthSimple for the entire tax season came from a tweet. They reached out to the author and offered to give money in exchange for being able to use it as an ad.

Simon Lejeune (VP Growth at Wealthsimple)

at 20:58

💎 It’s not always about creating hundreds of ad variations. Just make a funny, good ad, and it will outperform the rest.

Simon Lejeune (VP Growth at Wealthsimple)

at 21:54

Still on acquisition, here are some insights from Anton Volovyk (COO at Reface) in How Reface gained 180M+ downloads.

💎 PR is a cheap way to reach a larger audience and helps you figure out your branding and positioning by talking with journalists.

Anton Volovyk (COO at Reface)

at 15:22

💎 When you’re a small startup looking for virality, target the friends of people with more influence or “beginner celebrities.”

Anton Volovyk (COO at Reface)

at 18:15

💎 Learn more about the organic patterns of your users. When you see organic spikes, dig deeper to learn what worked and find opportunities to make it work more sustainably. This means talking to your users and experimenting with your product (e.g., Reface removing a share button in Sweden to understand how things are connected).

Anton Volovyk (COO at Reface)

at 27:25

💎 Once you see organic traffic spiking in a specific geo, make sure you start paid traffic there soon after.

Anton Volovyk (COO at Reface)

at 29:10

Pricing: willingness to buy, price relativity

We often talk about paywall optimization but not as much about price/offering optimization.

For apps with a significant volume, it can make a big impact.

Below are a few gems from 2 different videos on this topic.

💎 Use surveying to understand what features you should put behind a paywall. You can also use surveys to know how much they’re willing to pay: 2 models you can use:

Giancarlo Musetti (Growth Product Manager at Burner)

at 39:20 in Running Effective In-App Experiments

⛏️ Going Deeper: these are interesting methods to initially price a product, especially if it’s hard to compare it to something. But don’t forget to test once you’ve implemented them because people will not always really share (or know) what they’re willing to pay.

💎 To help define what your subscription includes and if people are willing to buy, you can also do smoke testing. Example for Ad Hoc Labs: showing users “Burner Plus” and seeing if they’re actually interested in purchasing by displaying a purchase CTA and then a screen “coming very soon.”

Giancarlo Musetti (Growth Product Manager at Burner)

at 40:38 in Running Effective In-App Experiments

💎 Offer two types of subscription (or multiple tiers) to shift the customer's question from “do I want to buy a subscription?” to “which subscription do I want to buy?”. This can be done with two different subscription lengths as well.

Sree Das (Head of Product for Allrecipes & Apps)

at 07:00 in Product Pricing Principles

💎 Offering a one-time free trial offer only during the signup process creates urgency. Example: Reflectly.

Sree Das (Head of Product for Allrecipes & Apps)

at 13:12 in Product Pricing Principles

💎 Your prices don’t exist in isolation: people always compare them to make their decision.

Sree Das (Head of Product for Allrecipes & Apps)

at 15:53

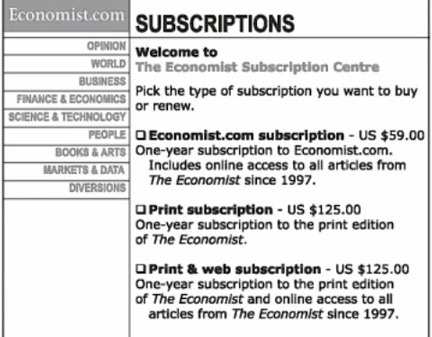

⛏️ Going Deeper: an example often referred to is the one from The Economist, where the price for the “print & web” subscription was the same as the one for just the “print” subscription.

That said, it’s worth noting that they don’t use this “decoy” anymore. It doesn’t take away anything from the insight on price relativity, and if you want to explore this further, you can check out the books Priceless (mentioned in Growth Gems #65), Dollars and Sense (mentioned by Sree in his talk), and Decoded.

And before I leave, a quote by Phil Schwarz (prev. CMO at Tinder) on the Sub Club podcast:

“Profit is effectively the new growth” - Phil Schwarz (Partner at Corazon Capital)

See you next time. Stay savvy!

⛏️ Sylvain