💎 Growth Gems #101 - Product and User Research: Product-Market Fit

Hey,

This week, I’m sharing gems:

These insights come from Andres Barreto, Rosie Hoggmascall, and more.

Enjoy!

Like this edition? Let me know!

🥇 TOP GEM OF THE WEEK

1. Product Market Fit: practical tactics for testing, measuring, and revising key hypotheses.

Gems from Andres Barreto (Managing Director at Techstars) in Product Market Fit Masterclass (Techstars)

A post on the Sub Club community by Jay Son (Founder at Lookscope) caught my attention: A hidden gem video on Product Market Fit.

So much has been written about finding product-market fit (PMF) that I wondered if this would be a good Growth Gems candidate.

But the talk resonated more with me than others I’ve watched, and I’m pretty sure I’ll want to reference back to those insights.

I don’t think I need to explain why PMF is essential. But I want to highlight that it’s not just an early-stage thing: it’s a never-ending endeavor as you grow and explore new growth areas (e.g., with new features, tiers, etc.).

Hopefully, you’ll find these gems valuable as well!

The high level

💎 3 things that can help you get to PMF:

Discover pain

Run experiments

Kill what does not work

(02:20)

Discover pain

💎 Write a prospect list of 10-20 possible customers to run interviews. You want to identify:

High level of pain

High frequency of pain

Will do something about that pain

The more specific you can be, the better.

(03:10)

Even if you have thousands or millions of users, Andres recommends continuing to do pain and customer discovery.

💎 5 different segments you should create from your customer interviews:

Pain does not exist: ignore them.

Pain exists, but the prospect does not know they have a pain: ignore them.

Pain exists. They know they have it, but it has not been quantified, and they will do nothing about it: ignore them.

Pain exists; they know about it, and they have quantified it, but they can afford to do nothing: ignore them.

Pain exists, knows about it, has quantified it, and are going to do something about it with or without you. Not doing something about it is not an option.

It’s ok to talk with categories 1-4 and understand patterns, but #5 is the group you want to experiment with.

(07:06)

This is where most people (me included) seem to get things wrong: it is easy to want to keep talking with potential customers as soon as we know they have the pain, but if your approach is too broad and you don’t focus on the right group you’ll waste time.

💎 Don’t ask “Would you like”? in customer interviews. Here is how to get real answers during customer discovery:

Talk about their life instead of your idea

Ask specifics about the past behavior (e.g.,” Tell me about the last time”, “what’s stopped you from?”) instead of generics and opinions about the future

Talk less and listen more

(13:20)

Andres explained this well with an example. Imagine you want to help customers remodel their homes, especially first-timers worried about getting ripped off. Don’t ask potential prospects, “Are you thinking of remodeling your home?”, “Would you like a service that helps you X, Y, Z?”, or “What do you want to remodel?”. You might get answers showing interest in all of this, yet if you ask, “Tell me about the last time you got quotes for remodeling”, then you can learn specifics about what happened: steps taken, what prevented them from moving forward, etc.

He recommended the book The Mom Test to find a good database of questions.

💎 During customer interviews, you’ll get the best results if you use:

Mirroring: repeat back the last few words or the main point just shared, then wait 4 seconds (count in your head), and interviews will share more

Labeling: make a conclusion/observation. Example: “It seems that the priorities are elsewhere”, etc.

(16:50)

He shared that when you ask a why question, it makes people defensive. Below is how Hannah Parvaz shared she still gets to the “Why”:

💎 In the early stages, understanding your customer's pain better than anybody else is your moat. Not patent or proprietary data. You win by understanding that pain and executing extremely quickly.

(19:20)

Run experiments

💎 Design, build, and run experiments to observe your customer’s behavior. This is not about building scalable software: you want to see if what people said (the ones with the pain and doing something about it) matches what they actually do.

(25:35)

The reasoning is that if you do the correct segmentation and choose the right group of people to focus on, their behavior will match the data.

💎 Here is how you can do experiments on a weekly basis.

With the problem defined, think of the result of the solution. Not the solution, just the result. Example: problem: I spend too much time and money remodeling my kitchen -> result: I spend less time and money remodeling my kitchen. What’s in the middle is what you design next.

Pick a launch date (e.g., Tuesday 3pm in 7 days): the only variable that does not change is time. Do the work for them, and no matter what put the results in their hands.

Then, observe their behavior to see if it matches what they told you in the interview and what they think of the result.

(26:45)

The short deadline is the forcing function to put something of value in the hands of your prospect(s), and focusing on the result first rather than building a sophisticated product first helps you focus on the right things once you do start building.

Killing what doesn’t work

💎 Kill ideas or experiments that did not work, and keep experimenting until you find a match between the data you have from interviews and their behavior.

(31:36)

What’s next? Retention

Andres did not address actually building the product and jumped to the quantitative aspect of measuring PMF: Level 4 of the product-market-fit game).

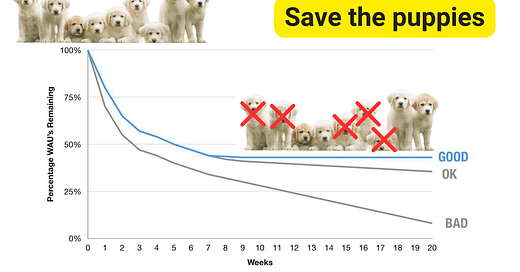

💎 Think about your cohorts as a litter of puppies. For each litter of puppies, you want puppies not to die. Ideally, you don’t just want puppies to stay alive; you also want them to get bigger and fatter over time. This shows the lifetime value expandability of cohorts.

(35:38)

Quite an interesting analogy there, and a good way to get people to pay attention to not only their retention but also growing their LTV.

So you want a cohort retention curve that flattens…

…and, ideally, additional usage/purchases from your existing cohorts.

Easier said than done, of course, particularly in gaming and subscription apps (unlike in SaaS, net retention revenue > 100% and “smiling retention curves” are not really a thing).

💎 Don’t accelerate growth at the first sight of a cohort that retains. Your goal is to constantly run experiments so you can acquire more of the users that you can retain. Eventually, you’ll run out of these users, and you’ll have to innovate via customer discovery again.

(47:40)

If you double the size of the cohorts because you think you’ve figured retention out, you might not be acquiring the right users anymore, which will show in the retention of those new cohorts.

Like this edition? Let me know!

2. User research to find product-market fit

Gems from Rosie Hoggmascall (Head of Growth at Perceptycs) in Pricing and User Research Impact On Growth (In Growth We Trust podcast)

Continuing on the theme of user research, once you already have customers, I liked what Rosie shared in this podcast episode about triangulating and continuous discovery.

💎 Triangulate product-market fit. Measure PMF in a couple of different ways so that you’re not just relying on one method. Look at different indicators: qualitative and quantitative.

Note: Don’t just use the “PMF survey”; some users might misunderstand the questions.(16:45)

Rosie advocates to look at several signals because customers don’t always tell the truth:

💎 If you have a tiny sample size and no users coming in, it’s hard to measure anything, including PMF, because there’s too much noise. You might need to turn the tap on for a channel first.

(20:35)

💎 Apps relying on a celebrity or built by a celebrity tend to have strong organic acquisition. But often, they can not just start/ramp up paid acquisition because new users acquired via paid have no context or lower intent, and the onboarding has been optimized for people who know the brand.

Example: book as an acquisition channel

(22:25)

This is why Eric Seufert advises starting paid acquisition early on, so you’re optimizing for a more future-looking acquisition mix (even though your initial paid efforts are likely to cater to a more niche/qualified audience as well) because “The sooner you layer in paid traffic, the more efficient your paid traffic will be.”

💎 Some companies do a big “user research” project that takes 3 months, takes a lot of time and energy, and produces a report that becomes obsolete. Inserting user research into your process is more manageable and scalable. Example: calendly link in the app “give the team feedback” that generates a couple of calls every week, a Typeform survey, etc.

(24:28)

💎 Something you can take away from the customer personas framework: create a card each time you do a user interview, a visual representation (cartoon or screenshot of them with their permission), name, key quotes, problems, and journey. This helps refresh your memory quickly when revisiting.

(27:00)

What Rosie suggests here is a little different than trying to follow the user persona framework: it’s a way to make customer interviews memorable and more oriented towards the user journey than demographics.

In his article Buyer personas need to die a violent death, you’ll read some compelling arguments by Louis Grenier against using traditional marketing personas and instead suggests more of an “archetype”/”jobs-to-be-done” approach.

💎 For user research, look at the data first to identify particular segments that retain well (e.g., people who do sleep exercise retain better than those who do a meditation exercise) or have higher Lifetime value. Then, do some qualitative research around that specific segment to better understand those users and have concrete user stories.

(30:55)

🎁 Bonus Gems

Some more insights you might find helpful on the user research and PMF topic!

💎 Finding product-market fit is not necessarily about “solving a problem”. In many instances, people are not conscious that they need a problem solved, and instead, PMF is found by making something 10x better (e.g., horses -> cars, Facebook -> TikTok).

Andrew Oh (Product Manager at Stripe, formerly TikTok) in The Process to Finding PMF (07:35)

This is a nice caveat to Andre’s process and insights I shared at the top of the newsletter because it reminds us that not all products are painkillers (which might make it harder to find PMF).

Andrew also shared some guidance when trying to find products that have a fit:

Build on top of existing behavior (something people are already doing)

Feed the ego (we are emotional beings)

Make a dream come true

💎 Product-market fit is not a binary thing: it’s a continuum, and you can always have more product-market fit. You can have multiple product-market fits if you’re dynamic with both your product and your marketing, which allows you to target multiple user segments.

Andy Carvell (Co-founder at Phiture) in One Size Doesn't Fit All: Diversifying UX for Incremental Gain at AGS Berlin (2:45:39)

Andy is not the only one saying this. Here is a quote from Greg Davis (Director of PMM at Atlas):

💎 The NY Times has a “product story” team that notices things starting to work in some of the one-offs/experimentation phases. Then, they test to find PMF for new formats that end up making the product more engaging (video, visuals, Live, etc.).

Alex Hardiman (Chief Product Officer at The New York Times) in An inside look at how the New York Times builds product (29:38)

Here, we can see that The New York Times is looking at PMF in the more granular “content-level” format.

💎 Step 1 is to establish product-market fit for the Ideal Customer Profile (ICP), people that exhibit strong retention today. Step 2 is to scale and own the market for the ICP. Step 3 is to build for the non-ICP in order.

Jesse Venticinque (Co-founder & CPO at Fitbod) in Product Lessons From a Profitable, $20M ARR Subscription App (28:45)

This plays into choosing offense vs. defense, where:

Defense is about maintaining PMF and preventing downside risks (competition, tech debt, etc.)

Offense is about investments that move the business forward (accelerating growth loops, expanding PMF into new platforms, adjacent audiences)

Defense is critical, but there comes a time when Offense is needed.

💎 You want to understand what is the problem that users are trying to solve by downloading your app and what is the actual perceived gap between the problem they’re trying to solve and the product solution. Process:

In your product analytics, identify a cohort of users who took some actions (e.g., 2-3 workout logs) and export a .csv.

Then go to userinterviews.com (which handles logistics/payment - free if you provide your users) and schedule 30-minute interviews with non-converters.

Jesse Venticinque (Co-founder & CPO at Fitbod) in Product Lessons From a Profitable, $20M ARR Subscription App (31:55)

💎 When you launch your app, it’s the worst it will ever be. So start by locking your entire app (with a free trial) to get the users that have enough of a pain point to be willing to pay for that app. Those are the early users you want to be building for.

Jake Mor (CEO at Superwall) in Paywall Optimization and Best Practices (15:27)

Interesting advice here from Jake on how a hard paywall can help you focus on building for the right users so you can find PMF.

And before I leave, here is a quote to remind us that people can say something but do something different (hence the importance of triangulating):

“User research in all forms can be bullshit” - Andrew Oh (Product Manager at Stripe, formerly TikTok)

See you next time. Stay curious!

⛏️ Sylvain

Like this edition? Let me know!

🔗 Sources:

Product Market Fit Masterclass, a Techstars video

Pricing and User Research Impact On Growth on the In Growth We Trust podcast

The Process to Finding PMF on Product School

One Size Doesn't Fit All: Diversifying UX for Incremental Gain at App Growth Summit Berlin

An inside look at how the New York Times builds product on Lenny’s Podcast

Product Lessons From a Profitable, $20M ARR Subscription App on the Sub Club podcast

Paywall Optimization and Best Practices, a RevenueCat webinar